A Guide To Understand What Is Mergers & Acquisitions

Mergers and acquisitions (M&A) is an approximate $3.6 trillion event that alters the long-term outlook of industries, companies, and even individual careers. Next to

By teammarquee . December 15, 2021

Mergers and acquisitions (M&A) is an approximate $3.6 trillion event that alters the long-term outlook of industries, companies, and even individual careers.

Next to an IPO, a merger or acquisition is the biggest corporate action that a business establishment can take in their lifetime. The role of M&A in the corporate world is so high that it is deemed almost ignorant for an entrepreneur to not know about it. We, at Marquee, are highly involved in the merger and acquisitions space and thus have made a guide for those in the business domain to understand the two concepts intimately.

So let’s start with the mergers and acquisitions meaning.

What is mergers and acquisitions?

In order to understand the mergers and acquisitions meaning, it is important for entrepreneurs to look into both the concepts separately.

What are mergers?

Mergers are a business strategy where two individual businesses are combined in a single entity to increase the overall operational and financial strengths of the company. There are usually two reasons why companies take the merger route:

- Save the production costs

- Get enough capital to enter a new market space or launch a new product.

What is an acquisition?

Business acquisition is basically the purchase of all or a part of a target company. It is a way for a company to acquire another company’s strengths and synergies to become a bigger brand. The reasons behind acquisitions generally lie in:

- Greater market share

- Access to new technologies and underutilized assets

- Access to the new distribution channels.

A simpler definition of what is an acquisition can also be that it is an event where the acquiring company purchases the target company’s asset and gains complete decision making power over it.

Now while mergers and acquisitions are used as interchangeable terms, there are some key differences that lie between both. There are some clear distinctive points in merger vs acquisition strategies.

Mergers vs acquisitions

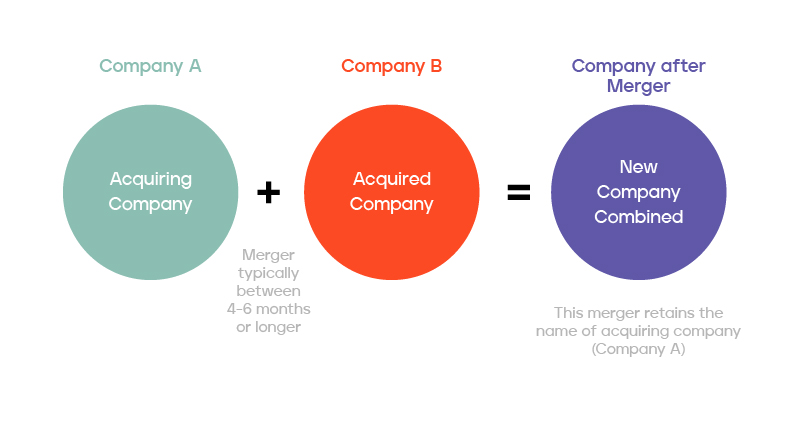

Merger occurs when two individual entities combine their resources and operations to become one new brand. While on the other hand, acquisition is the takeover of one business entity by another brand.

Let us highlight the difference between merger and acquisition further. Typically, in mergers, a new establishment is formed while in acquisition no new company is brought into existence. Instead, the smaller company is made to cease to exist as its assets become part of the large business. One of the reasons why the difference between merger and acquisition is less talked about and both the terms are used interchangeably is the negative commotion that is attached to the word ‘acquisition’.

What are the different type of merger and acquisitions deals?

Once you have got an understanding of what is merger and acquisitions, the next part lies in understanding what are the different types of mergers and acquisition deals. There can be a number of m&a deal structures that a company follows, but the most common ones of those are:

Horizontal merger

This type of merger and acquisition strategies are prevalent in events where two companies, both operating in the same market come together to build a strong market share. This approach is best suited when businesses are looking to decrease competitions and build economies of scale.

Vertical merger

In this approach, the two companies work in the same domain but are at separate levels of production. This could be a retailer merging with a wholesaler or vice versa. It is ideal for smoothening operations, increasing efficiencies, and cutting down business costs.

Concentric merger

It is one of the most popular types of acquisition. In this approach, the target company and the acquirer offer different products but operate in the same market. They can be indirect competitors whose products complement each other’s business model. The key reason behind this popular m&a deal structure is to allow the business entity to increase the market share and expand the product line.

Conglomerate merger

These types of mergers happen between companies whose businesses are completely unrelated. Here, two businesses come together to expand market reach or enter a new product or service space.

While this was about the types of mergers, when we look whole and sole at the types of acquisitions, two distinctive elements will come up – Stock purchase and Asset purchase. In stock purchase, the acquirer pays the target firm’s shareholders shares or cash in exchange for their share of the company’s stock. In case of asset purchase, the acquirer pays for the target’s assets.

Now irrespective of the types of merger and acquisition deals, the end results are more or less the same. Let us look into the reasons behind why businesses go for m&a in the next section.

Why mergers and acquisitions continue to be a profitable prospective for businesses?

Irrespective of the merger and acquisition strategies a business adopts, the end result of it more or less falls under one of these categories –

Greater growth – Merging or acquiring of two businesses enables them to achieve greater income and revenue at a much faster rate than they would have been able to achieve organically as individual units.

Better synergy – M&A, when done right, helps create better synergy or value proposition. In the event of m&a, two firms are able to bring their strengths and resources into a new entity which is a best outcome of both the businesses’ individual efforts.

Diversification – Mergers and acquisitions enable businesses to move in a new domain and enter a new territory with new target audience and market reach. An example of this could be seen in GE moving to banking from electronics.

Horizontal and vertical integration – Merger and acquisition of two businesses, whether vertical or horizontal, helps create a new business entity which has a powerful distribution channel, a greater market presence, and a higher probability of earning great revenues.

Up until this point, we have looked into the different facets of the m&a analysis. But a key factor that remains to be discussed is the merger and acquisition process.

There are a number of different processes that individual M&A facilitator businesses offer to both the parties. What we are going to highlight now is specific to Marquee. We have used the same steps when we helped a crypto payment platform, a flash sales ecommerce platform, successfully achieve M&A. Without further ado, let us dive into them.

Merger and acquisitions process

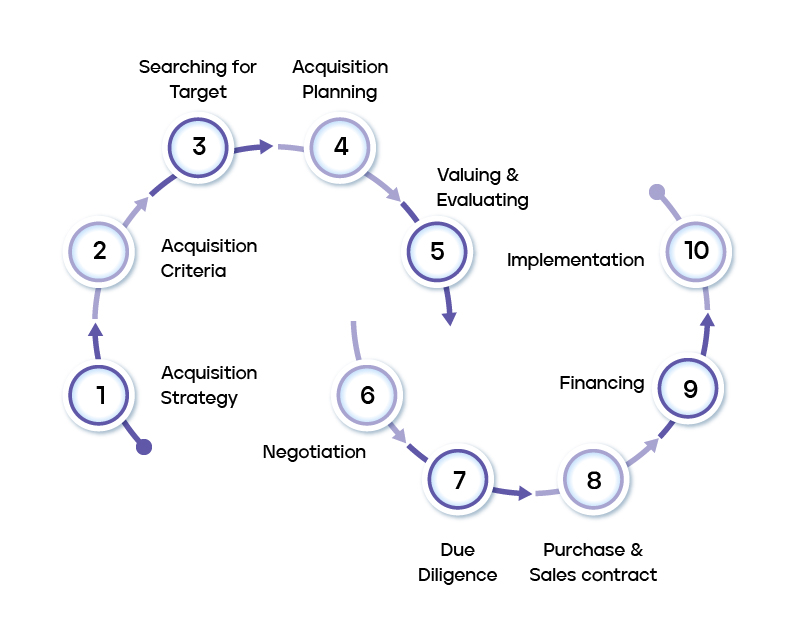

- Build an acquisition strategy – The first step in understanding how do acquisitions work lies in making a strategy around the event. It revolves around the acquirer having an understanding of what they expect to achieve from the acquisition.

- Set an M&A search guideline – The key elements of identifying the best potential target companies are set here. It can be their geographical location, the y-o-y profit numbers, and the customer base.

- Initiate the acquisition planning – The acquirer creates a contact with potential companies (with a value offering) to check how willing they are to a potential acquisition and merger.

- Conduct valuation analysis – The acquirer asks the target company to provide them substantial information around their financials and business models etc. to help gauge them as an acquisition target.

- Negotiation – Once the vibes have been checked between the companies and the financials are verified, the acquirer presents an initial offer to the target company. At this point, the negotiation starts between them in terms of minute operational and business processes.

- M&A due diligence – It is a process that aims at confirming the acquirer’s assessment of the target company’s assets by conducting a detailed examination of every aspect of the target company’s operations – customers, finances, assets and liabilities, etc.

- Sale and purchase contract – The parties here make a final decision on the purchase agreement and decide whether it would be a stock purchase or an asset one. Here the details of the finances are discussed and laid down in black and white.

- Integration of the M&A – The deal is signed off and the management teams of both the forms work together to merge the firms into one establishment.

So here was everything there is to know about mergers and acquisitions – what it is, how businesses benefit from the event, and the process that is followed to see them through. Now that you have understood how it works, it is time to prepare your business to either be acquired or to acquire another firm. Our M&A team at Marquee can help you with both. Get in touch with us today.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.